BlackRock’s Bitcoin ETF Entry Outperforms ‘Magnificent Seven’ Stocks

The inflow into BlackRock’s Bitcoin exchange-traded fund (ETF) has surpassed the inflow into the “magnificent seven” stocks in 2024, including tech giants Microsoft, Apple, Tesla, Amazon, Meta, Alphabet and Nvidia.

BlackRock’s iShares Bitcoin Trust ETF has accumulated nearly $19 billion worth of Bitcoin since the beginning of the year (YTD), outpacing inflows into the much-vaunted “magnificent seven” stocks. This notable trend was highlighted by Jeroen Blokland, founder of Blockland Smart Asset Fund, in a July 23 post on X.

“That’s more than Invesco’s Nasdaq 100 ETF, which includes the overhyped Fab 7 stocks and the AI boom. Also, Fidelity’s spot Bitcoin ranks 11th, generating $10 billion in inflows,” Blokland said.

These significant inflows make Bitcoin the world’s second-largest asset class in terms of inflows this year, despite Bitcoin’s market cap being 90 times smaller than stocks. This increase highlights investors’ growing appetite for Bitcoin as a major financial asset.

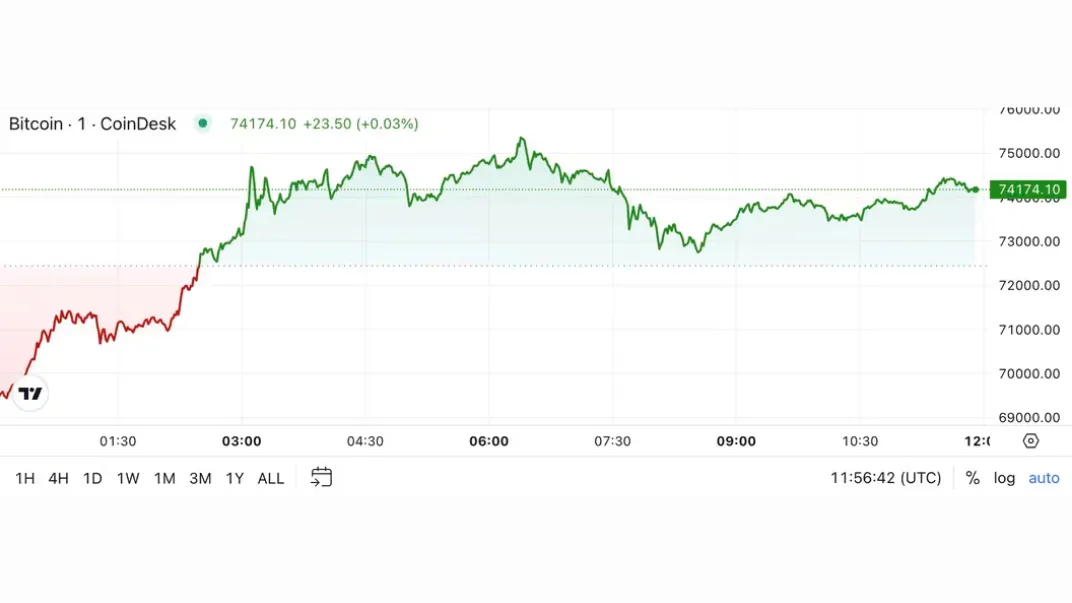

Bitcoin ETFs in the US have now surpassed $61 billion in total on-chain assets, meaning the ETFs hold more than 4.6% of the total Bitcoin supply. In the past week alone, US spot Bitcoin ETFs have seen net inflows exceeding $1 billion, driven by the launch of the first spot Ethereum ETFs in the US. BTC currently trades at $66,000 and is down 2% in the past 24 hours following news that BTC from bankrupt exchange Mt Gox has been returned to creditors.